Client Appreciation Day brunch will be April 27th at the Lansdowne Resort in Leesburg, Virginia. Our guest speaker is Commander Kirk Lippold, USN (ret), Commanding Officer of the USS Cole when the ship was attacked by al-Qaeda terrorist in the Yemeni port of Aden. His story of leadership is both fascinating and relevant today considering events around the world. Don’t miss this extraordinary and historically significant event.

The first quarter concludes with the S&P 500 finishing up 10.16% for the quarter and up 30.45% year-over-year. These gains follow both the bear market of 2022 and the fastest Federal Reserve interest rate hike cycle in history. Despite the significant increase in borrowing costs, the economy appears unfazed, carrying on as if conditions prior to 2022 persist.

In a notable shift, the Leading Economic Indicators moved from contraction to expansion at the end of March, marking the first such positive signal in over two consecutive years. However, March’s Consumer Price Index (CPI) surpassed expectations, sparking discussions of ‘sticky’ inflation in the media. While not the most welcome news for investors, a closer examination of the CPI report reveals overlooked positives.

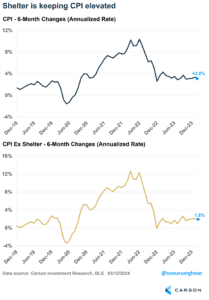

Though CPI often dominates media attention, the Federal Reserve primarily focuses on the Core Personal Consumption Expenditures (PCE) Index. The Fed’s apparent disregard for CPI may stem from concerns about the subjective nature of certain data components, such as the “Owners’ Equivalent Rent,” which comprises a significant portion of CPI despite its detachment from home prices or mortgage rates

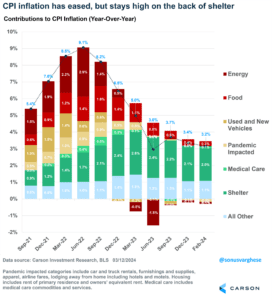

Carson Investment Research’s first chart below illustrates the shifting components of CPI over recent years, with notable changes across various sectors except for ‘Shelter.’ Energy, once a significant contributor, now detracts from CPI. The second chart demonstrates CPI data both with and without shelter inflation, revealing a stark difference in March’s figures.

The Personal Consumption Expenditure index for March reflects a 2.8% year-over-year increase, indicating a sustained trend down toward the Fed’s 2% inflation target. The US’s dominance in crude oil production has played a crucial role in maintaining stability amidst global conflicts, such as the Russia-Ukraine war and the Israel-Gaza conflict.

While we believe the Fed has a handle on inflation, our analysis indicates a ‘higher for longer’ environment for interest rates to prevent a resurgence in inflation. Nevertheless, we remain optimistic about the resilient economy’s ability to navigate through the year ahead. With the advent of Artificial Intelligence, large, well-capitalized company stocks will benefit from the new technology to squeeze even more profits out of sales. Our outlook remains optimistic for stocks as they continue to be the best hedge against inflation and an optimal long-term investment option.

| Thomas A. Toth, Senior Chairman | Kenneth Bowen, II President & CEO |